where's my unemployment tax refund irs

For eligible taxpayers this could result in a refund a reduced balance due or no change to tax. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online.

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

The unemployment tax refund is only for those filing individually.

. By Anuradha Garg. There is no right to privacy in this system. If its been more than three weeks since you e-filed your 2020 tax return and you still havent received anything or if the Wheres My Refund tool tells you to contact the IRS you can call 800-829-1040.

But the unemployment tax refund can be seized by the IRS to pay debts that are past due. Check For the Latest Updates and Resources Throughout The Tax Season. According to your site it has been more than 30 days.

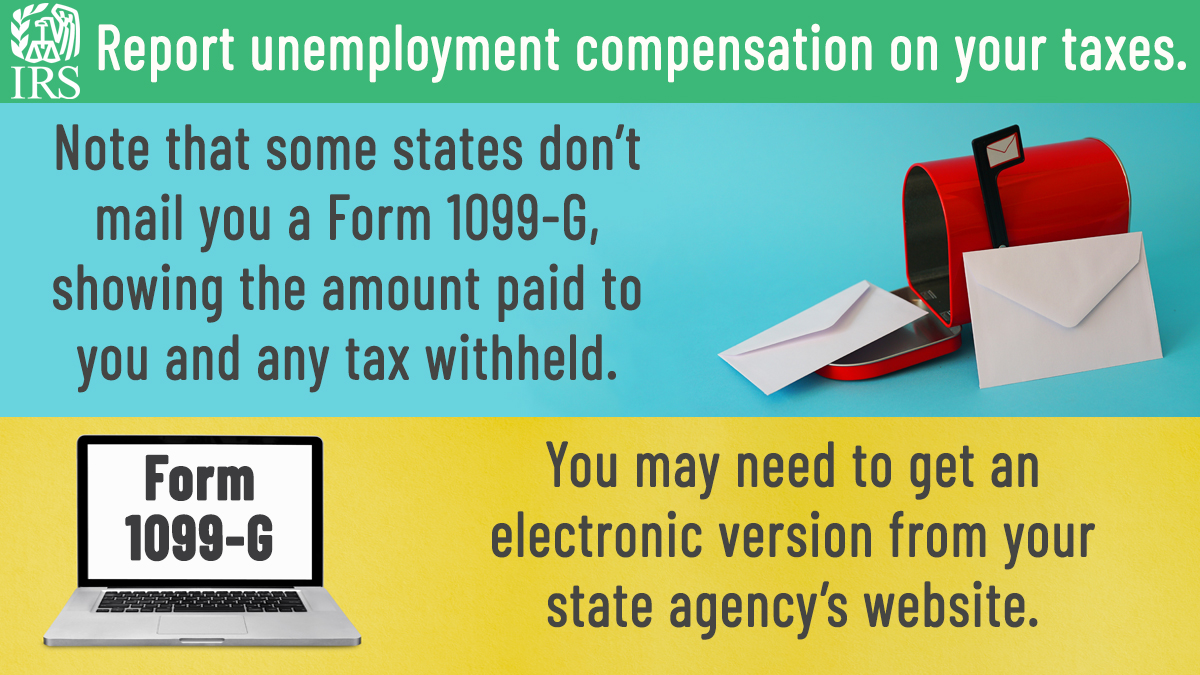

The IRS is starting to send money to people who fall in this categorywith more refunds slated to arrive this summer. COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax. This includes unpaid child support and state or federal taxes.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. Use of this system constitutes consent to monitoring interception recording reading copying or capturing by authorized personnel of all activities. Ad Learn How to Track Your Federal Tax Refund and Find The Status of Your Paper Check.

Refunds will go out as a direct deposit if you provided bank account information on your 2020 tax return. CBS -- The Internal Revenue Service is sending more than 28 million refunds this week to taxpayers who paid taxes on unemployment compensation. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946.

A direct deposit amount will likely show up as IRS TREAS 310 TAX REF Otherwise the refund will be mailed as a paper check to whatever address the IRS has on hand. The IRS has sent letters to taxpayers. To check your return online use the Wheres My Refund service or the IRS2Go mobile app.

See How Long It Could Take Your 2021 State Tax Refund. You may use our refund inquiry application to check the status of your current year refund. How to Check the Status of Your Refund.

Every 24 hours the systems are upgraded. I have lost or misplaced my refund check how do I go about getting a new one. 22 2022 Published 742 am.

This is the most efficient and easiest way to track your return. Unauthorized use of this system is prohibited and subject to criminal and civil penalties including all penalties applicable to willful unauthorized. For a replacement check you must call the Comptrollers Office at 1-800-877-8078.

June 4 2021 214 PM CBS Chicago. I have not received my refund check. FYI the IRS phone number for stimulus check questions is.

If you received unemployment benefits last yearyou may be eligible for a refund from the IRS. The phone lines are open Monday through Friday 7 am. Where is my unemployment tax break refund.

Is IRS still sending out unemployment refunds. Ad Learn How Long It Could Take Your 2021 State Tax Refund. An immediate way to see if the IRS processed your refund is by viewing your tax records online.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online. The first10200 in benefit income is free of federal income taxper legislation passed in March. You can try the IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool but they may not provide information on the status of your unemployment tax refund.

The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946.

Where Is My Money Smokey Where Is My Money Tax Refund Unemployment

Irsnews On Twitter If You Received Unemployment Compensation During The Year You Must Include It In Gross Income On Your Irs Tax Return See Details At Https T Co Lhsbya2bvu Https T Co Vfio1irxik Twitter

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

Tax Refunds 2022 Why Did You Only Get Half Of Your Tax Return Marca

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Where S My Irs Refund Paper Returns Taking Months To Process

Unemployment Tax Refund Update What Is Irs Treas 310 King5 Com

Where S My Irs Refund Payment Schedule Revealed As Millions Get 3 103 On Average

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Has Sent 6 Billion In Stimulus Payments Just In June Here S How To Track Your Money

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs